This is one of the best letters that Heather Cox Richardson has written since I started reading her posts. It puts the current Supreme Court’s radical decisions into historical perspective. This Court, hand-picked by Leonard Leo and the Federalist Society, is engaged in a shameless effort to move the clock back to the world as it existed before the New Deal. This Court threatens our democracy and our rights.

She writes:

Today the Supreme Court followed up on yesterday’s decision gutting affirmative action with three decisions that will continue to push the United States back to the era before the New Deal.

In 303 Creative LLC v. Elenis the court said that the First Amendment protects website designer Lorie Smith from having to use words she doesn’t believe in support of gay marriage. To get there, the court focused on the marriage website designer’s contention that while she is willing to work with LGBTQ customers, she doesn’t want to use her own words on a personalized website to celebrate gay marriages. Because of that unwillingness, she said, she wants to post on her website that she will not make websites for same-sex weddings. She says she is afraid that in doing so, she will run afoul of Colorado’s anti-discrimination laws, which prevent public businesses from discriminating against certain groups of people.

This whole scenario of being is prospective, by the way: her online business did not exist and no one had complained about it. Smith claims she wants to start the business because “God is calling her ‘to explain His true story about marriage.’” She alleges that in 2016, a gay man approached her to make a website for his upcoming wedding, but yesterday, Melissa Gira Grant of The New Republic reported that, while the man allegedly behind the email does exist, he is an established designer himself (so why would he hire someone who was not?), is not gay, and married his wife 15 years ago. He says he never wrote to Smith, and the stamp on court filings shows she received it the day after she filed the suit.

Despite this history, by a 6–3 vote, the court said that Smith was being hurt by the state law and thus had standing to sue. It decided that requiring the designer to use her own words to support gay marriage violated the First Amendment’s guarantee of free speech.

Taken together with yesterday’s decision ruling that universities cannot consider race as a category in student admissions, the Supreme Court has highlighted a central contradiction in its interpretation of government power: if the Fourteenth Amendment limits the federal government to making sure that there is no discrimination in the United States on the basis of race—the so-called “colorblind” Constitution—as the right-wing justices argued yesterday, it is up to the states to make sure that state laws don’t discriminate against minorities. But that requires either protecting voting rights or accepting minority rule.

This problem has been with us since before the Civil War, when lawmakers in the southern states defended their enslavement of their Black (and Indigenous) neighbors by arguing that true democracy was up to the voters and that those voters had chosen to support enslavement. After the Civil War, most lawmakers didn’t worry too much about states reimposing discriminatory laws because they included Black men as voters first in 1867 with the Military Reconstruction Act and then in 1870 with the Fifteenth Amendment to the Constitution, and they believed such political power would enable Black men to shape the laws under which they lived.

But in 1875 the Supreme Court ruled in Minor v. Happersett that it was legal to cut citizens out of the vote so long as the criteria were not about race. States excluded women, who brought the case, and southern states promptly excluded Black men through literacy clauses, poll taxes, and so on. Northern states mirrored southern laws with their own, designed to keep immigrants from exercising a voice in state governments. At the same time, southern states protected white men from the effects of these exclusionary laws with so-called grandfather clauses, which said a man could vote so long as his grandfather had been eligible.

It turned out that limiting the Fourteenth Amendment to questions of race and letting states choose their voters cemented the power of a minority. The abandonment of federal protection for voting enabled white southerners to abandon democracy and set up a one-party state that kept Black and Brown Americans as well as white women subservient to white men. As in all one-party states, there was little oversight of corruption and no guarantee that laws would be enforced, leaving minorities and women at the mercy of a legal system that often looked the other way when white criminals committed rape and murder.

Many Americans tut-tutted about lynching and the cordons around Black life, but industrialists insisted on keeping the federal government small because they wanted to make sure it could not regulate their businesses or tax them. They liked keeping power at the state level; state governments were far easier to dominate. Southerners understood that overlap: when a group of southern lawmakers in 1890 wrote a defense of the South’s refusal to let Black men vote, they “respectfully dedicated” the book to “the business men of the North.”

In the 1930s the Democrats under President Franklin Delano Roosevelt undermined this coalition by using the federal government to regulate business and provide a social safety net. In the 1940s and 1950s, as racial and gender atrocities began to highlight in popular media just how discriminatory state laws really were, the Supreme Court went further, recognizing that the Fourteenth Amendment’s declaration that states could not deprive any person of the equal protection of the laws meant that the federal government must protect the rights of minorities when states would not. Those rules created modern America.

This is what the radical right seeks to overturn. Yesterday the Supreme Court said that the Fourteenth Amendment could not address racial disparities, but today, like lawmakers in the 1870s, it signaled that it would not protect voting in the states either. It rejected a petition for a review of Mississippi’s strict provision for taking the vote away from felons. That law illustrates just how fully we’re reliving our history: it dates from the 1890 Mississippi constitution that cemented power in white hands. Black Mississippians are currently 2.7 times more likely than white Mississippians to lose the right to vote under the law.

The court went even further today than allowing states to choose their voters. It said that even if state voters do call for minority protections, as Colorado’s anti-discrimination laws do, states cannot protect minorities in the face of someone’s religious beliefs. In her dissent, Justice Sonia Sotomayor wrote that for “the first time in its history,” the court has granted “a business open to the public a constitutional right to refuse to serve members of a protected class.”

It is worth noting that segregation was defended as a deeply held religious belief.

Today, using a case concerning school loans, the Supreme Court also took aim at the power of the federal government to regulate business. In Biden v. Nebraska the court declared by a vote of 6 to 3 that President Biden’s loan forgiveness program, which offered to forgive up to $20,000 of federally held student debt, was unconstitutional. The right-wing majority of the court argued that Congress had not intended to give that much power to the executive branch, although the forgiveness plan was based on law that gave the secretary of education the power to “waive or modify any statutory or regulatory provision applicable to the student financial assistance programs…as the Secretary deems necessary in connection with a…national emergency…to ensure” that “recipients of student financial assistance…are not placed in a worse position financially in relation to that financial assistance because of [the national emergency]”.

The right-wing majority based its decision on the so-called major questions doctrine, invented to claw back regulatory power from the federal government. By saying that Congress cannot delegate significant decisions to federal agencies, which are in the executive branch, the court takes on itself the power to decide what a “significant” decision is. The court established this new doctrine in the West Virginia v. Environmental Protection Agencycase, stripping the EPA of its ability to regulate certain kinds of air pollution.

“Let’s not beat around the bush,” constitutional analyst Ian Millhiser wrote today in Vox, today’s decision in Biden v. Nebraska “is complete and utter nonsense. It rewrites a federal law which explicitly authorizes the loan forgiveness program, and it relies on a fake legal doctrine known as ‘major questions’ which has no basis in any law or any provision of the Constitution.”

Today’s Supreme Court, packed as it has been by right-wing money behind the Federalist Society and that society’s leader, Leonard Leo, is taking upon itself power over the federal government and the state governments to recreate the world that existed before the New Deal.

Education Secretary Miguel Cardona called out the lurch toward turning the government over to the wealthy, supported as it is by religious footsoldiers like Lorie Smith: “Today, the court substituted itself for Congress,” Cardona told reporters. “It’s outrageous to me that Republicans in Congress and state offices fought so hard against a program that would have helped millions of their own constituents. They had no problem handing trillion-dollar tax cuts to big corporations and the super wealthy.”

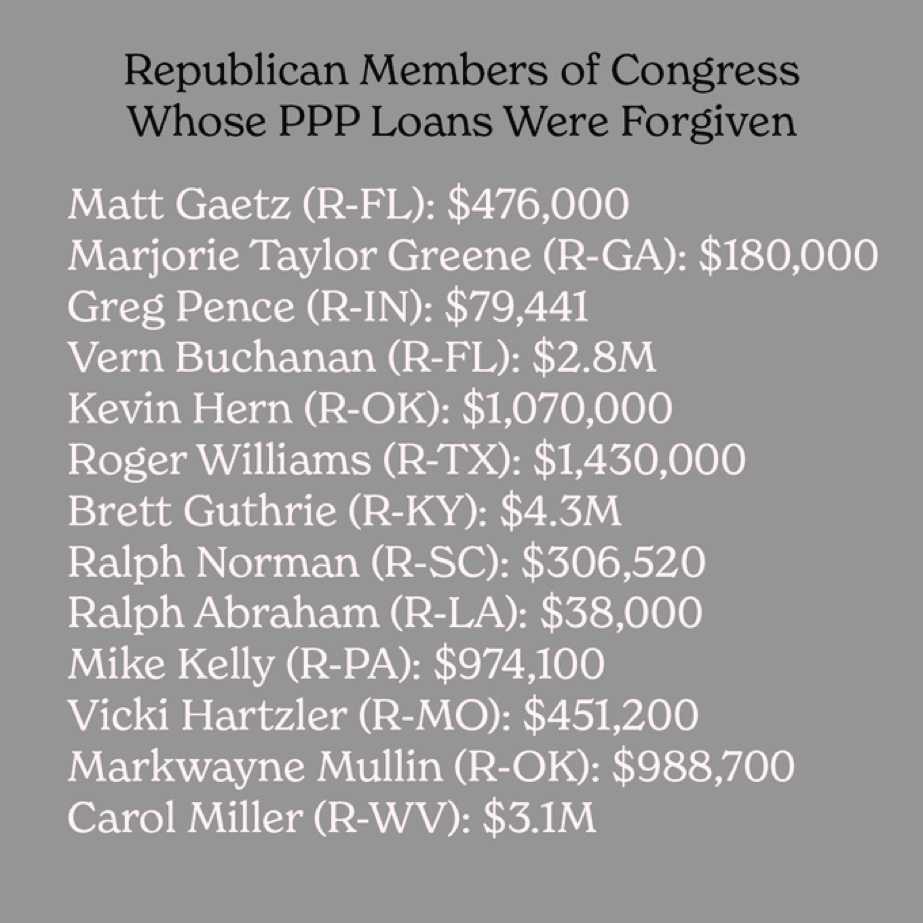

Cardona made his point personal: “And many had no problems accepting millions of dollars in forgiven pandemic loans, like Senator Markwayne Mullin from Oklahoma had more than $1.4 million in pandemic loans forgiven. He represents 489,000 eligible borrowers that were turned down today. Representative Brett Guthrie from Kentucky had more than $4.4 million forgiven. He represents more than 90,000 eligible borrowers who were turned down today. Representative Marjorie Taylor Greene from Georgia had more than $180,000 forgiven. She represents more than 91,800 eligible borrowers who were turned down today.”

In the majority opinion of Biden v. Nebraska, Chief Justice John Roberts lamented that those who dislike the court’s decisions have accused the court of “going beyond the proper role of the judiciary.” He defended the court’s decision and urged those who disagreed with it not to disparage the court because “such misperception would be harmful to this institution and our country.” But what is at stake is not simply these individual decisions, whether or not you agree with them; at stake is the way our democracy operates.

Norman Ornstein of the American Enterprise Institute didn’t offer much hope for Roberts’s plea. “It is not just the rulings the Roberts Court is making,” he tweeted. “They created out of [w]hole cloth a bogus, major questions doctrine. They made a mockery of standing. They rewrite laws to fit their radical ideological preferences. They have unilaterally blown up the legitimacy of the Court.”

In a shot across the bow of this radical court, in her dissent to Biden v. Nebraska, Justice Elena Kagan wrote that “the Court, by deciding this case, exercises authority it does not have. It violates the Constitution.”

—