PBS ran a special about the love affair between America’s far-right extremists and Hungary’s authoritarian leader Viktor Orban. Here is the transcript. It’s worth reading to understand the extremism and not-so-latent fascism embedded in America’s right wing.

In 2013, I visited Cuba with my partner and two old friends. It was legal. It is still legal.

We had a spectacular trip arranged by a Cuban-born travel agent. Her name is Myriam Castillo. You can contact her here:

mcastillo@bespoke-cct.com

She is thorough, efficient, and thoughtful.

We stayed in a beautiful hotel in Havana. We visited excellent restaurants. We had tour guides wherever we went. We visited museums, artists’ homes, and historical sites.

We flew nonstop from Miami. I understand there are nonstop flights now from other cities.

The most exciting moment of the trip for me was when I got the ticket stub that said “Miami-Havana.” After 63 years of non-contact, it was thrilling.

The food was wonderful. The people were welcoming. The sight of 1950s American automobiles, in perfect condition, with leather seats, all in vibrant colors, was fabulous.

Myriam had an agent waiting for us at Jose Marti Airport. The agent helped us check into the hotel. An SUV drove us to places outside Havana.

If you want the thrill of a lifetime, this is the vacation to plan.

I was thinking of titling this post “Libertarian Crackpots Take Charge of School Funding in New Hampshire” but decided to bite my tongue.

Garry Rayno, a writer for InDepthNH.org, reports that the Koch-funded plan to defund public schools in New Hampshire is a “success.” Not because most parents want to put their children in private or religious schools, but because the overwhelming majority of students using the new education freedom accounts are already enrolled in nonpublic schools. Thus, public funds are now underwriting private education. At some point, the public schools will shrink to be just one among many choices even though the people of New Hampshire never voted to abandon their community public schools. This is a theft of public dollars for private use.

By GARRY RAYNO, InDepthNH.org

The new education freedom account program is a success judging by the number of students participating in the first year.

More students are expected to participate in the second year and state education officials predict it will continue to grow into the future.

One of the most expansive school choice programs in the country, it was sold as a way for students and parents to find the best educational avenues to fit their student’s individual learning needs.

That would be wonderful and would fulfill the education department’s long-standing goal of individualized student pathways, but that is not what happened for a majority of students.

Instead the program has increased the state’s education spending while few students changed their learning environment.

The vast majority of students — around 85 percent — participating in the first year, did not attend public schools the year before. Instead they were in private or religious schools, or home schooled, or too young for school.

That does not change the learning environment for that 85 percent of students.

What did change under the program was the parents’ financial obligations, which were reduced thanks to the influx of state taxpayers’ money.

Department of Education Commissioner Frank Edelblut, a program advocate, told lawmakers the first year of freedom accounts would cost the state’s Education Trust Fund about $300,000 and the second year about $3.2 million. Instead the cost was close to $9 million this year.

Why the increase? Edelblut’s estimates were for students leaving traditional public schools to participate in alternative programs, not for those already in other programs applying for state help to cover the costs of private and religious schools, or home schooling.

Essentially most of the state money flowed through the parents to private and religious schools and for homeschooling costs all previously paid for by the parents or religious institutions.

When the program was first debated this term, the nonpartisan Legislative Budget Assistant’s office estimated the state’s exposure could be as high as $70 million if all the students in private or religious schools applied for grants.

The program provides grants to parents of students who earn no more than 300 percent of the federal poverty level or about $80,000 a year for a family of four.

You only have to qualify once, so if the next year your family makes $125,000, you still qualify and if you double that the next year, you still qualify.

Grants range from about $4,500 to $8,000 per student with the average the first year a little under $5,000 per student.

The money can be spent in any number of ways, for tuition, books and instructional programs, supplies, computers, individual instruction on a musical instrument, etc.

The money to pay for the freedom accounts comes from the Education Trust Fund established more than 20 years ago when the state overhauled its funding system after the Claremont II Supreme Court decision saying the then current system of relying on local property taxes with widely varying rates to pay for public education was unconstitutional because it violated the proportional and reasonable clause of the state constitution.

For most of its early years, the trust fund ran a deficit and state general fund money had to be added to meet the state’s education aid obligations.

In recent years the fund has had a surplus including this biennium. The state budget passed last year estimates a $54.4 million surplus at the end of last fiscal year June 30 and a $21 million surplus at the end of the 2023 fiscal year.

The surplus at the end of last fiscal year is much larger than that as the overall state revenue surplus is more than $400 million, but most of that has already been spent through legislation this year such as the $100 million settlement fund for the children abused at the Youth Detention Center.

The law establishing the freedom accounts has a provision if the education fund does not have enough money to cover the cost of the grants, the needed money will be withdrawn from general fund revenue without any action needed from the legislature or the governor.

Such a provision is extremely rare as lawmakers like to be able to determine how general funds are spent.

The number of students participating in the program the first year would probably not be so large if not for the American for Prosperity, an “education organization” funded by the Koch network and other like thinking libertarians who have longed advocated that public education tax money also pay for private and religious schools, homeschooling and charter schools.

The New Hampshire affiliate had a campaign ready to go when the freedom account legislation passed as part of the budget package last year. The group helped parents enroll their students in the program, many who were in private or religious schools or home schooled.

Last week the same organization held an “education fair” for parents to meet representatives of some of the organizations and groups approved to other alternative education programs under the freedom account program.

The fair was promoted by Education Commissioner Frank Edelblut who tweeted a photo from the fair, and the department had a booth there to promote its 603 Moment campaign on social media.

Others touting the fair included members of the House freedom caucus and others in the free state/libertarian wing of the GOP.

The fair is intended to help grow the program, meaning more state money will be drawn from the Education Trust Fund and ultimately the state’s general fund.

This is a well planned operation that only required the state to agree to a school choice program with few guardrails to begin taking the state down the road to greater educational “freedom” and less traditional public education.

The Koch network has recently developed a proposal to “reform” public education with one of its officials calling public education the “low hanging fruit.”

The reform would look a lot like what the freedom account program looks like and would shift resources as it does away from traditional public education to alternative pathways.

As the freedom account program grows, observers of the legislature know what will happen eventually.

As more and more education trust fund money is allocated, there will be pressure to reduce the amount of money going to traditional public education and, depending on which party is in control, to charter schools.

That is how public education becomes the low hanging fruit.

The education commissioner and others talk about the achievement gap between students from well off areas and minority students and those from low-income families.

Edelblut maintains that gap has not changed in 50 years despite numerous efforts on the federal and state level and says that is why education needs to change.

He downplays what the recent education funding commission made the centerpiece of its work, that the achievement gap is due to the resources available to students.

Students from property poor communities perform below students from property wealthy communities.

The economic disparity gap between students from property wealthy and property poor communities is larger now than it was when the Claremont lawsuit was filed 30 years ago.

Proponents of alternative education programs say it is not about spending more money, and the education funding commission said the same thing.

But the commission said the resources needed to be distributed differently, while the advocates for freedom accounts say it is about finding the right fit for a student.

Those advocates are saying the issue is not economic disparity.

Ultimately their goal is to make government smaller and they can accomplish that by disrupting traditional public education with lower cost, less regulated alternative programs.

Eventually traditional education will be small enough to be just one more alternative pathway for students among many.

That is why public education is the low-hanging fruit and freedom accounts are just the beginning.

Ryan Grim wrote this post before the final passage of the mini-Build Back Better Bill. But the point is still on target. The bill is good because it’s the best we can hope for in a Senate where Democrats have only 50 votes, and two of those votes are precarious. In a perfect world, the Democrats would have 62 votes in the Senate and could pass a perfect bill. But we don’t live in a perfect world. The Republicans are unanimously opposed to any legislation to address climate change or to curb the costs of health care. This, for now, is the best that can be done. Do not scoff at half-measures. They are way better than nothing, and the Republicans strongly prefer nothing. They want to go into the mid-terms with a battered Biden presidency that accomplished nothing. They are not thinking of the people they claim to represent. Biden needed this victory, but so do the American people. Think of it as a first step.

In the Texas governor’s race between the vile Gregg Abbott and challenged Beto O’Rourke, the candidates are fighting for rural votes on the issue of vouchers. Rural Republicans have a strong allegiance to their public schools, which are often the heart of the community and its biggest employer. Many rural communities do not have any other schools.

Yet Governor Abbott has supinely sought the approval of Betsy DeVos’s American Federation of Children.

The Texas Tribune summed up the conflict:

A battle over school vouchers is mounting in the race to be Texas governor, set into motion after Republican incumbent Greg Abbott offered his clearest support yet for the idea in May.

His Democratic challenger, Beto O’Rourke, is hammering Abbott over the issue on the campaign trail, especially seeking an advantage in rural Texas, where Democrats badly know they need to do better and where vouchers split Republicans. O’Rourke’s campaign is also running newspaper ads in at least 17 markets, mostly rural, that urge voters to “reject Greg Abbott’s radical plan to defund” public schools.

Abbott, meanwhile, is not shying away from the controversy he ignited when he said in May that he supports giving parents “the choice to send their children to any public school, charter school or private school with state funding following the student.” He met privately last week with Corey DeAngelis, an aggressive national school choice activist who had previously criticized Abbott as insufficiently supportive of the cause.

“School choice” tends to refer to the broad concept of giving parents the option to send their kids to schools beyond their local public school, while vouchers would allow parents to use state tax dollars to subsidize tuition for those other options, including private schools. Opponents of vouchers say they harm public school systems by draining their funding. In the Legislature, vouchers have long encountered resistance from Democrats and rural Republicans whose public schools are the lifeblood of their communities.

O’Rourke is leaning into the bipartisan salience of the issue.

“For our rural communities, where there’s only one school district and only one option of public school, he wants to defund that through vouchers, take your tax dollars out of your classroom and send it to a private school in Dallas or Austin or somewhere else at your expense,” O’Rourke told a rural audience recently.

As usual, the voucher vultures are pushing the lie that money taken away from your public school will allow children to attend elite private schools.

It can’t be said often enough: voucher funds are never enough to pay for elite public funds. It is a lie. Voucher funding ranges from $4,000 to $8,000. The tuition at elite private schools ranges from $30,000 to $70,000.

Elite private schools don’t have vacancies. When they do, they don’t seek to enroll poor kids.

After 25 years of vouchers, the research is clear: kids who leave community public schools for voucher schools lose academic ground. Large numbers return to their public schools.

Meanwhile public schools are grievously harmed by the withdrawal of funding. They must lay off teachers and cut programs.

If the Devil designed a program to hurt the public schools, he would call it vouchers. And it would be funded by the American Federatuon for Chiildren.

The FBI executed a search warrant approved by a federal judge and searched Trump’s home in Florida in search of government documents that were illegally removed from the White House when Trump grudgingly left office.

It is a felony to remove classified documents from the White House or other government offices. We like to think that “no man is above the law,” but we have seen too many exceptions. For example, it is obvious that Trump incited the attack in the U.S. Capitol. He even wanted to join the mob as it ransacked the building. Yet he says the mob acted on its own and his followers insist the mob was really Antifa. Too bad he didn’t join the mob so he couldn’t disclaim any responsility. Isn’t it a crime to incite an insurrection? But no man is above the law.

Trump issued a statement in which he whined that the FBI raid on his manor was no different from the break-in to the DNC headquarters at Watergate.

But historian Michael Beschloss explained the difference last night on MSNBC. The Watergate break-in was a criminal act. The raid on Mar-A-Lago was authorized by a federal judge and carried out lawfully in search of documents that Trump took with him from the White House. All presidential documents are supposed to be turned over to the National Archives. They are the property of the federal government, not the president’s personal property. Refusing to return them is a felony.

Trump’s loyal supporters in Congress are outraged. They believe that he is above the law.

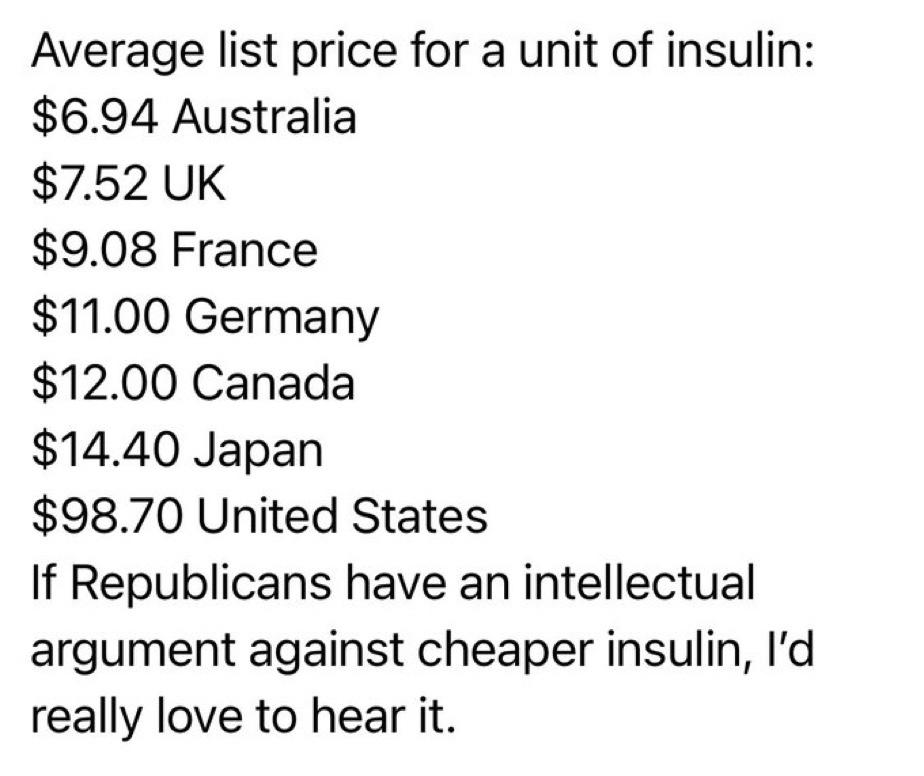

Democrats needed 60 votes to pass a $35 monthly cap on the price of insulin. Republicans, led by Senator Lindsey Graham, made sure that there would not be 10 Republican votes for the measure.

Republican lawmakers on Sunday successfully stripped a $35 price cap on the cost of insulin for many patients from the ambitious legislative package Democrats are moving through Congress this weekend, invoking arcane Senate rules to jettison the measure.

The insulin cap is a long-running ambition of Democrats, who want it to apply to patients on Medicare and private insurance. Republicans left the portion that applies to Medicare patients untouched but stripped the insulin cap for other patients. Bipartisan talks on a broader insulin pricing bill faltered earlier this year.

The Senate parliamentarian earlier in the weekend ruled that part of the Democrats’ cap, included in the Inflation Reduction Act, did not comply with the rules that allow them to advance a bill under the process known as reconciliation — a tactic that helps them avert a GOP filibuster. That gave the Republicans an opening to jettison it.

“Republicans have just gone on the record in favor of expensive insulin,” said Sen. Ron Wyden (D-Ore.). “After years of tough talk about taking on insulin makers, Republicans have once against wilted in the face of heat from Big Pharma.”

Some Republicans did support the price cap in the 57-43 vote for the measure, but not enough joined Democrats in support of it to meet the threshold for passage.

More than 1 in 5 insulin users on private medical insurance pay more than $35 per month for the medicine, according to a recent analysis from the Kaiser Family Foundation.

Some 7 million Americans require insulin daily. A Yale University study found that 14 percent of those insulin users are spending more than 40 percent of their income after food and housing costs on the medicine.

The seven Republicans who voted with the Democrats were: Senators Susan Collins of Maine, Josh Hawley of Missouri, Cindy Hyde-Smith of Mississippi, Lisa Murkowski and Dan Sullivan of Alaska, and John Kennedy and Bill Cassidy of Louisiana.

Mary Trump tweeted that Josh Hawley, a fierce partisan, must have a relative with diabetes. Or maybe the Republicans drew straws to see who would cast a futile vote against a popular measure.

Tweet by @toylsome

Question: Will Republican voters remember in November?

Senators Joe Manchin and Kyrsten Sinema were the two Democrats whose support for the Inflation Reduction Act was in doubt until the very end. Manchin won protection for the fossil fuel industry. Sinema killed taxes that would hit the hedge fund industry. The Washington Post explains here:

Senate Democrats agreed Sunday to protect firms owned by the private equity industry from a new minimum tax on billion-dollar corporations, bowing to pressure from Sen. Kyrsten Sinema (D-Ariz.), who insisted on making the change to the Democrats’ sprawling climate, health-care and tax package.

The decision came as Democrats tried to hold their caucus together through nearly 19 hours of debate over the Inflation Reduction Act of 2022, which the 50-50 Senate approved Sunday with the help of a tiebreaking vote from Vice President Harris.

The package proposes hundreds of billions of dollars in fresh spending, financed in part through new taxes, including a corporate minimum tax that would require firms with more than $1 billion in annual profits to pay a tax rate of at least 15 percent. As originally written, the provision would have required private equity firms to tally profits from their various holdings and pay the tax if the total exceeded the $1 billion threshold.

Sinema, who for over a year has blocked Democratic ambitions to raise taxes, raised objections on Saturday, according to two people with knowledge of the matter, who spoke on the condition of anonymity to discuss private talks.

The senator argued that, without changes to the bill, small and medium-sized businesses that happen to be owned by private equity firms would be exposed to the tax, violating a Democratic pledge to hike taxes only on the largest firms. A Sinema spokeswoman said several Arizona small businesses, including a plant nursery, had raised concerns.

The senator’s objections came days after she persuaded Democrats to abandon a different effort to raise taxes on private equity managers by closing the so-called “carried interest loophole,” which permits investment managers to pay lower rates on certain portions of their income.

In a statement, Sinema’s office said her goal is to “target tax avoidance, make the tax code more efficient, and support Arizona’s economic growth and competitiveness.”

“At a time of record inflation, rising interest rates, and slowing economic growth, Senator Sinema knows that disincentivizing investments in Arizona businesses would hurt Arizona’s economy’s ability to create jobs, and she ensured the Inflation Reduction Act helps Arizona’s economy grow,” the statement said.

The last-minute changes mark a significant victory for the private equity industry and an estimated savings of $35 billion over the next decade. Private equity represents a roughly $4 trillion industry in the United States, and as the sector has grown markedly over the past decade, it has flexed its considerable political muscle repeatedly in Washington.

From the start, the unusual way private equity businesses are structured posed a challenge for Democrats crafting the new minimum tax. Typically, large conglomerates are formed as “C corporations” under the tax code and pay corporate taxes. The new minimum tax would clearly apply to them. But private equity firms are legally formed as partnerships, which typically pay taxes on the individual returns of their owners. Senate Democrats say they crafted the legislation to ensure that wealthy investment managers who own numerous C corporations and other business entities collectively worth more than $1 billion would be subject to the tax.

But the tax was never intended to hit the smaller subsidiaries that make up private equity portfolios, said Ashley Schapitl, a spokeswoman for Senate Finance Committee Chairman Ron Wyden (D-Ore.), who called industry claims to that effect “nonsense.”

Independent analysts largely agreed with that reading of the provision. “The language in the bill was intended to make sure they are treated the same way,” said Steve Wamhoff, a tax expert at the Institute on Taxation and Economic Policy, a left-leaning think tank. “The idea that billion-dollar private equity funds must be protected to save small businesses is absolutely absurd.”

Senator Joe Manchin of West Virginia and Senator Krysten Sinema held the power to block the Democrats’s ambitious bill to reduce carbon emissions and improve healthcare. Each of them extracted a hefty price in exchange for their vote, one that benefited either their state, their campaign donors, or themselves personally.

This analysis by the New York Times shows that Manchin got a trifecta: a win for the coal industry (big in his state), a win for his campaign donors, and a win for himself. Sinema demanded the removal of taxes on private equity firms..

Plenty of West Virginians are angry at Manchin. They are environmentalists. Senator Manchin takes care of the fossil fuel industry, not them.

BLACKSBURG, Va. — After years of spirited opposition from environmental activists, the Mountain Valley Pipeline — a 304-mile gas pipeline cutting through the Appalachian Mountains — was behind schedule, over budget and beset with lawsuits. As recently as February, one of its developers, NextEra Energy, warned that the many legal and regulatory obstacles meant there was “a very low probability of pipeline completion.”

Then came Senator Joe Manchin III of West Virginia and his hold on the Democrats’ climate agenda.

Mr. Manchin’s recent surprise agreement to back the Biden administration’s historic climate legislation came about in part because the senator was promised something in return: not only support for the pipeline in his home state, but also expedited approval for pipelines and other infrastructure nationwide, as part of a wider set of concessions to fossil fuels.

It was a big win for a pipeline industry that, in recent years, has quietly become one of Mr. Manchin’s biggest financial supporters.

Natural gas pipeline companies have dramatically increased their contributions to Mr. Manchin, from just $20,000 in 2020 to more than $331,000 so far this election cycle, according to campaign finance disclosures filed with the Federal Election Commission and tallied by the Center for Responsive Politics. Mr. Manchin has been by far Congress’s largest recipient of money from natural gas pipeline companies this cycle, raising three times as much from the industry than any other lawmaker.

NextEra Energy, a utility giant and stakeholder in the Mountain Valley Pipeline, is a top donor to both Mr. Manchinand Senator Chuck Schumer, Democrat of New York, who negotiated the pipeline side deal with Mr. Manchin. Mr. Schumer has received more than $281,000 from NextEra this election cycle, the data shows. Equitrans Midstream, which owns the largest stake in the pipeline, has given more than $10,000 to Mr. Manchin. The pipeline and its owners have also spent heavily to lobby Congress.

The disclosures point to the extraordinary behind-the-scenes spending and deal-making by the fossil fuel industry that have shaped a climate bill that nevertheless stands to be transformational. The final reconciliation package, which cleared the Senate on Sunday, would allocate almost $400 billion to climate and energy policies, including support for cleaner technologies like wind turbines, solar panels and electric vehicles, and put the United States on track to reduce its emissions of planet-warming gases by roughly 40 percent below 2005 levels by the decade’s end.

Read the rest of the story in the New York Times.

President Biden proposed a $2.2 trillion investment in stopping climate change, expanding health care, and other ambitious goals. But Democrats hold only 50 seats in the Senate, and the defection of only one vote would kill any bill. As it happened, the Democrats had two Senators who blocked Biden’s plans: Joe Manchin of West Virginia and Kyrsten Sinema of Arizona. Both demanded and won concessions. The bill that passed over the weekend is still a dramatic improvement over doing nothing, but the holdouts watered it down.

Except for Manchin and Sinema, every Democrat supported the bill; the two holdouts required concessions. Every single Republican opposed every part of the bill, except for the part lowering the monthly cost of insulin, supported by 7 Republicans, not enough to save the proposal.

As a general proposition, the vote on the bill shows that Republicans are staunchly opposed to any legislation to slow the devastating effects of climate change and overwhelmingly opposed to lowering the cost of prescription drugs. The seven Republicans who voted with the Democrats were probably given permission by Leader McConnell to break ranks, since their seven votes were insufficient to pass the provision.

WASHINGTON — After months of painstaking negotiations, Democrats are set to push through a climate, tax and health care package that would salvage key elements of President Biden’s domestic agenda.

The legislation, while falling far short of the ambitious $2.2 trillion Build Back Better Act that the House passed in November, fulfills multiple longstanding Democratic goals, including countering the toll of climate change on a rapidly warming planet, taking steps to lower the cost of prescription drugs and to revamping portions of the tax code in a bid to make it more equitable.

Here’s what’s in the final package:

It is the largest single American investment to slow global warming.

The bill includes the largest expenditures ever made by the federal government to slow global warming and to reduce demand for the fossil fuels that are primarily responsible for causing climate change.

Energy experts said the measure would help the United States to cut greenhouse gas emissions about 40 percent below 2005 levels by the end of this decade. That puts the Biden administration in striking distance of meeting its goal of cutting emissions roughly in half by 2030. Far more will be needed to help keep the planet from warming to dangerously high global temperatures, scientists said, but Democrats considered it a momentous first step after decades of inaction.

It would invest nearly $400 billion over 10 years in tax credits aimed at steering consumers to electric vehicles and prodding electric utilities toward renewable energy sources like wind or solar power.

A number of fossil fuel and drilling provisions as concessions to Senator Joe Manchin III of West Virginia, a holdout from a conservative state that is heavily dependent on coal and gas.

The measure would assure new oil drilling leases in the Gulf of Mexico and Alaska’s Cook Inlet. It would expand tax credits for carbon capture technology that could allow coal or gas-burning power plants to keep operating with lower emissions. And it would mandate that the Interior Department continue to hold auctions for fossil fuel leases if it plans to approve new wind or solar projects on federal lands.

The tax credits include $30 billion to speed the production of solar panels, wind turbines, batteries and critical minerals processing; $10 billion to build facilities to manufacture things like electric vehicles and solar panels; and $500 million through the Defense Production Act for heat pumps and critical minerals processing.

There is $60 billion to help disadvantaged areas that are disproportionately affected by climate change, including $27 billion for the creation of what would be the first national “green bank” to help drive investments in clean energy projects — particularly in poor communities. The bill would also force oil and gas companies to pay fees as high as $1,500 a ton to address excess leaks of methane, a powerful greenhouse gas, and it would undo a 10-year moratorium on offshore wind leasing established by President Donald J. Trump.

Medicare could directly negotiate the price of prescription drugs, pushing down costs.

For the first time, Medicare would be allowed to negotiate with drugmakers on the price of prescription medicines, a proposal projected to save the federal government billions of dollars. That would apply to 10 drugs initially, beginning in 2026, and then expand to include more drugs in the following years.

Opponents argue that the plan would stifle innovation and the development of new treatments by cutting into the profits that drug companies can plow into their business, while some liberals expressed frustration that the policy would be too slow to take hold. Should the package become law, as expected, it would be the largest expansion of federal health policy since passage of the Affordable Care Act.

The package would cap the out-of-pocket costs that seniors pay annually for prescription drugs at $2,000, and would ensure that seniors have access to free vaccines. Lawmakers also included a rebate should price increases outpace the rate of inflation. (Top Senate rules officials, however, said that penalty could apply only to Medicare, not private insurers.)

Republicans successfully challenged the inclusion of a $35 price cap on insulin for patients on private insurance during a rapid-fire series of amendment votes early Sunday morning, forcing its removal. But a separate proposal that caps the price of insulin at $35 per month for Medicare patients remained intact….

The tax proposals were shaped by Senator Kyrsten Sinema, Democrat of Arizona, who resisted her party’s push to increase tax rates on the country’s wealthiest corporations and individuals.

To avoid the rate increase Ms. Sinema opposed, Democrats instead settled on a far more complex change to the tax code: a new 15 percent corporate minimum tax on the profits companies report to shareholders. It would apply to companies that report more than $1 billion in annual income on their financial statements but that are also able to use credits, deductions and other tax treatments to lower their effective tax rates.

Ms. Sinema did protect a deduction that would benefit manufacturers, a change she successfully demanded before committing on Thursday to moving forward with the legislation. And she joined six other Democrats and all Republicans in narrowing the scope of that corporate minimum tax by backing an amendment in the final hours of the vote-a-rama Sunday afternoon.

Democrats, to make up for the loss of revenue forced by that amendment, extended a limit on tax deductions for business losses that was enacted as part of the Trump tax cuts in 2017.

She also forced the removal of a proposalsupported by Democrats and Republicans that would have narrowed a tax break used by both hedge fund and private equity industries to secure lower tax rates than their entry-level employees. And she committed to pursuing separate legislation outside of the budget package, but that would require at least 10 Republicans to support it.