Thom Hartmann explains the lies, hoaxes, And scams that Republicans use to deceive middle-income people to vote for them, against their self-interest. He shows how Jeb Bush tilted the election of 2000 in favor of his brother George.

This is a must-read.

Hartmann writes:

The GOP — to keep the support of “average” American voters while they work entirely for the benefit of giant corporations, the weapons and fossil fuel industries, and the morbidly rich — have run a whole series of scams on voters ever since the original Reagan grift of trickle-down economics.

Oddly, there’s nothing comparable on the Democratic side. No lies or BS to justify unjustifiable policies: Democrats just say up-front what they’re all about:

Healthcare and quality education for all. Treat all people and religions with respect and fairness. Trust women to make their own decisions. Raise the pay of working people and support unionization. Get assault weapons off the streets. Do something about climate change. Clean up toxic waste sites and outlaw pesticides that damage children. Replace fossil fuels with renewable energy.

Nonetheless, the media persists in treating the two parties as if they were equally honest and equally interested in the needs of all Americans. In part, that’s because one of the GOP’s most effective scams — the “liberal media bias” scam — has been so successful ever since Lee Atwater invented it back in the early years of the Reagan Revolution.

For example, right now there’s a lot of huffing and puffing in the media about how the Supreme Court might rule in the case of Trump being thrown off the ballot in Colorado. They almost always mention “originalism” and “textualism” as if they’re honest, good-faith methods for interpreting the Constitution when, in fact, they’re cynical scams invented to justify unjustifiable rulings.

Thus, the question: how much longer will Americans (and the American media) continue to fall for the GOP’s scams?

They include:

— Originalism: Robert Bork came up with this scam back in the 1980s when Reagan appointed him to the Supreme Court and he couldn’t come up with honest or reasonable answers for his jurisprudential positions, particularly those justifying white supremacy. By saying that he could read the minds of the Founders and Framers of the Constitution, Bork gave himself and future generations of Republicans on the Court the fig leaf they needed.

The simple fact is that there was rarely a consensus among the Framers and among the politicians of the founding generation about pretty much anything. And to say that we should govern America by the standards of a white-men-only era before even the industrial revolution much less today’s modern medicine, communications, and understanding of economics is absurd on its face.

— Voter Fraud: This scam, used by white supremacists across the South in the years after the failure of Reconstruction to prevent Black people from voting, was reinvented in 1993, when Bill Clinton and Democrats in Congress succeeded in passing what’s today called the “Motor Voter” law that lets states automatically register people to vote when they renew their driver’s licenses. Republicans freaked out at the idea that more people might be voting, and claimed the new law would cause voter fraud (it didn’t).

By 1997, following Democratic victories in the 1996 election, it had become a major meme to justify purging voting rolls of Black and Hispanic people. Today it’s the justification for over 300 voter suppression laws passed in Red states in just in the past 2 years, all intended to make it harder for working class people, minorities, women, the elderly dependent on Social Security, and students (all Democratic constituencies) to vote.

The most recent iteration of it is Donald Trump‘s claim that the 2020 election, which he lost by fully 7 million votes, was stolen from him by voter fraud committed by Black people in major cities.

As a massive exposé in yesterday’s Washington Post titled “GOP Voter-Fraud Crackdown Overwhelmingly Targets Minorities, Democrats” points out, the simple reality is that voter fraud in the US is so rare as to be meaningless, and has never, ever, anywhere been documented to swing a single election.

But Republicans have been using it as a very effective excuse to make it harder for Democratic voters to cast a ballot, and to excuse their purging almost 40,000,000 Americans off the voting rolls in the last five years.

Right To Work (For Less): back in the 1940s, Republicans came up with this scam. Over the veto of President Harry Truman, they pushed through what he referred to as “the vicious Taft-Hartley Act,” which lets states make it almost impossible for unions to survive. Virtually every Red state has now adopted “right to work,” which has left their working class people impoverished and, because it guts the political power of working people, their minimum wage unchanged.

— Bush v Gore: The simple reality is that Al Gore won Florida in 2000, won the national popular vote by a half-million, and five Republicans on the Supreme Court denied him the presidency. Florida Governor and George W. Bush’s brother Jeb had his Secretary of State, Kathryn Harris, throw around 90,000 African Americans off the voting rolls just before the election and then, when the votes had come in and it was clear former Vice President Al Gore had still won, she invented a new category of ballots for the 2000 election: “Spoiled.”

As The New York Times reported a year after the 2000 election when the consortium of newspapers they were part of finally recounted all the ballots:

“While 35,176 voters wrote in Bush’s name after punching the hole for him, 80,775 wrote in Gore’s name while punching the hole for Gore. [Florida Secretary of State] Katherine Harris decided that these were ‘spoiled’ ballots because they were both punched and written upon and ordered that none of them should be counted.

“Many were from African American districts, where older and often broken machines were distributed, causing voters to write onto their ballots so their intent would be unambiguous.”

George W. Bush “won” the election by 537 votes in Florida, because the statewide recount — which would have revealed Harris’s crime and counted the “spoiled” ballots, handing the election to Gore (who’d won the popular vote by over a half-million) — was stopped when George HW Bush appointee Clarence Thomas became the deciding vote on the Supreme Court to block the recount order from the Florida Supreme Court.

Harris’ decision to not count the 45,599 more votes for Gore than Bush was completely arbitrary; there is no legal category and no legal precedent, outside of the old Confederate states simply refusing to count the votes of Black people, to justify it. The intent of the voters was unambiguous. And the 5 Republicans on the Supreme Court jumped in to block the recount ordered by the Florida Supreme Court (in violation of the 10th Amendment) just in time to prevent those “spoiled” votes from being counted, cementing Bush’s illegitimate presidency.

— Money is “Free Speech” and corporations are “persons”: This scam was invented entirely by Republicans on the Supreme Court, although billionaire GOP donors — infuriated by campaign contribution and dark money limits put into law in the 1970s after the Nixon bribery scandals — had been funding legal efforts to get it before the Court for years.

In a decision that twists logic beyond rationality, the five Republicans on the Court — over the strong, emphatic objections of all the Democrats on the Court — ruled that our individual right to free speech guaranteed in the First Amendment also includes the “right to listen,” as I lay out in detail in The Hidden History of the Supreme Court and the Betrayal of America and they wrotein Citizens United:

“The right of citizens to inquire, to hear, to speak, and to use information to reach consensus is a precondition to enlightened self-government and a necessary means to protect it.”

Without being able to hear from the most knowledgeable entities, they argued, Americans couldn’t be well-informed about the issues of the day.

And who was in the best position to inform us? As Lewis Powell himself wrote in the Bellottidecision, echoed in Citizens United, it’s those corporate “persons”:

“Corporations and other associations, like individuals, contribute to the ‘discussion, debate, and the dissemination of information and ideas’ that the First Amendment seeks to foster…”

“Political speech is ‘indispensable to decision-making in a democracy, and this is no less true because the speech comes from a corporation rather than an individual.’ … The inherent worth of the speech in terms of its capacity for informing the public does not depend upon the identity of its source, whether corporation, association, union, or individual.”

They doubled down, arguing that corporations and billionaires should be allowed to dump unlimited amounts of money into the political campaigns of those politicians they want to own so long as they go into dark money operations instead of formal campaigns. What was called “bribery” for over 200 years is now “free speech”:

“For the reasons explained above, we [five Republicans on the Supreme Court] now conclude that independent expenditures, including those made by corporations, do not give rise to corruption or the appearance of corruption.”

— Cutting taxes raises revenue: As Nobel Prize-winning economist Paul Krugman notes, the idea promoted by Reagan, Bush, and Trump to justify almost $30 trillion in cumulative tax cuts for billionaires and giant corporations is “The Biggest Tax Scam in History.”

Reagan first pitched this to justify cutting the top income tax rate on the morbidly rich from 74% down to 25% in the 1980s, and it was reprised by both George W. Bush and Donald Trump for their own massive tax breaks for their well-off donors and peers.

The simple fact is that America went from a national debt of over 124% of GDP following World War II to a national debt of a mere $800 billion when Reagan came into office. We’d been paying down our debt steadily, and had enough money to build the interstate highway system, brand new schools and hospitals from coast to coast, and even to put men on the moon.

Since Reagan rolled out his tax scam, however, our national debt has gone from less than a trillion in 1980 to over 30 trillion today: we’re back, in terms of debt, to where we were during WWII when FDR raised the tippy-top bracket income tax rate to 90% to deal with the cost of the war. We should be back to that tax rate for the morbidly rich today, as well.

— Destroying unions helps workers: In their eagerness to help their corporate donors, Reagan rolled out a novel idea in 1981, arguing that instead of helping working people, corrupt “union bosses” were actually ripping them off.

Union leaders work on a salary and are elected by their members: the very idea that they, like CEOs who are compensated with stock options and performance bonuses and appointed by their boards, could somehow put their own interests first is ludicrous. Their only interest, if they want to retain their jobs, is to do what the workers want.

But Reagan was a hell of a salesman, and he was so successful with this pitch he cut union membership in America during his and his VP’s presidency by more than 50 percent.

— Corporations can provide better Medicare than the government: For a corporation to exist over the long term, particularly a publicly-traded corporation, it must produce a profit. That’s why when George W. Bush and friends invented the Medicare Advantage scam in 2003 they allowed Advantage providers to make as much as 20 percent in pure profit.

Government overhead for real Medicare is around 2% — the cost of administration — and corporations could probably run their Advantage programs with a similar overhead, but they have to make that 20% profit nut, so they hire larger staffs to examine every single request to pay for procedures, surgeries, tests, imaging, and even doctors’ appointments. And reject, according to The New York Times, around 18% of them.

“Advantage plans also refused to pay legitimate claims, according to the report. About 18 percent of payments were denied despite meeting Medicare coverage rules, an estimated 1.5 million payments for all of 2019.”

When they deny you care, they make money. If they ran like real Medicare and paid every bill (except the fraudulent ones), they’d merely break even, and no company can do that. Nonetheless, Republicans continue to claim that “choice” in the marketplace is more important than fixing Medicare.

With the $140 billion that for-profit insurance companies overcharge us and steal from our government every year, if Medicare Advantage vanished there would be enough money left over to cut Medicare premiums to almost nothing and add dental, vision, and hearing. But don’t expect Republicans to ever go along with that: they take too much money from the insurance industry (thanks to five corrupt Republicans on the Supreme Court).

— More guns means more safety: Remember the NRA’s old “The only way to stop a bad guy with a gun is a good guy with a gun”? They’re still at it, and there’s hardly a single Republican in America who will step up and do anything about the gun violence crisis that is uniquely experienced by our nation.

Bullets are now the leading cause of death among children in the US, and we’re literally the only country in the entire world for which that is true. And a child living in Red state Mississippi is ten times more likely to die from a gun than a child in Blue state Massachusetts. But as long as the NRA owns them, Republicans will never do anything about it.

— The media has a liberal bias: This canard was started by Lee Atwater in an attempt to “work the refs” of the media, demanding that they stop pointing out the scams Republicans were engaging in (at the time it was trickle-down). The simple reality is that America’s media, from TV and radio networks to newspapers to websites, are overwhelmingly owned by billionaires and corporations with an openly conservative bent.

There are over 1500 rightwing radio stations (and 1000 religious broadcasters, who are increasingly political), three rightwing TV networks, and an army of tens of thousands of paid conservative activists turning out news releases and policy papers in every state, every day of the year. There are even well-funded social media operations.

There is nothing comparable on the left. Even MSNBC is owned by Comcast and so never touches issues of corporate governance, media bias (they fired Brian Stelter!), or the corruption of Congress by its big pharma and Medicare Advantage advertisers.

— Republicans are the party of faith: Republicans claim to be the pious ones, from Mike Johnson’s creepy “chastity ball” with his daughter, to their hate of queer people, to their embrace of multimillionaire TV and megachurch preachers. But Democrats, who are more accepting of people of all faiths and tend not to wear their religion on their sleeves, are the ones following Jesus’ teachings.

Jesus, arguably the founder of Christianity, was emphatic that you should never pray in public, do your good deeds in private as well, and that the only way to get to heaven is to feed the hungry, house the homeless, heal the sick, and love every other human as much as you love yourself.

Republicans, on the other hand, wave their piety like a bloody shirt, issue press releases about their private charities, and fight every effort to have our government feed the hungry, house the homeless, heal the sick, or even respect, much less love, people who look or live or pray differently from them.

— Crime is exploding and you’re safer living in an area Republicans control: In fact, crime of almost all sorts is at a low not seen since 1969. Only car thefts are up, and some of that appears to have to do with social media “how to” videos and a few very vulnerable makes of autos.

New FBI statistics find that violent crime nationwide is down 8 percent; in big cities it’s down nearly 15 percent, robbery and burglary are down 10 and 12 percent respectively.

But what crime there is is overwhelmingly happening in Red states. Over the past 21 years, all types of crime in Red states are 23 percent higher than in Blue states: in 2020, murder rates were a mind-boggling 40 percent higher in states that voted for Trump than those Biden carried.

— Global warming is a hoax: Ever since fossil fuel billionaires and the fossil fuel industry started using the legal bribery rights five corrupt Republicans on the Supreme Court created for them, virtually every Republican politician in the nation is either directly on the take or benefits indirectly from the massive infrastructure created by the Koch brothers and other fossil fuel barons. As a result, it’s almost impossible to find even one brave, truthful Republican who’s willing to do anything about the climate crisis that is most likely to crash not just the US but civilization itself.

— Hispanic immigrants are “murderers and rapists”: Donald Trump threw this out when he first announced his candidacy for president in 2015, saying, “They are bringing drugs. They are bringing crime. They’re rapists.” In fact, Hispanic immigrants (legal or without documentation) are far less likely, per capita and by any other measure, to commit crime of any sort than white citizens.

— Helping people makes them lazy. The old Limbaugh joke about “kicking people when they’re down is the only way to get them up” reveals the mindset behind this Republican scam, which argues that when people get money or things they didn’t work for it actually injures them and society by making them lazy. The GOP has used this rationalization to oppose everything from unemployment insurance in the 1930s to food stamps, Medicaid, and housing supports today.

In fact, not only is there no evidence for it, but studies of Universal Basic Income (UBI), where people are given a few hundred dollars a month with no strings attached, finds that the vast majority use the extra funds to improve themselves. They upgrade their housing, look for better jobs, and go back to school.

If the morbidly rich people behind the GOP who promote this scam really believed it, they’d be arguing for a 100% estate tax, to prevent their own children from ending up “lazy.” Good luck finding any who are leaving their trust-fund kids destitute.

— Tobacco doesn’t cause cancer: Back in 2000, soon-to-be Indiana Governor and then-Congressman Mike Pence wrote a column that was published statewide saying, “Despite the hysteria from the political class and the media, smoking doesn’t kill.” Pence’s family had made money off tobacco for years with a small chain of now-bankrupt convenience stores called “Tobacco Road,” but he was also being spiffed by the industry.

Similarly, George W. Bush pushed the “Healthy Forests Initiative” as president after big contributions from the timber industry: “healthy” meant “clear cut.” Bush also had his “Clear Skies Initiative” that let polluters dump more poison into our air. And the Trump administration, after big bucks and heavy lobbying from the chemical and Big Ag industries, refused to ban a very profitable pesticide used on human food crops that was found to definitely cause brain damage and cancer in children.

— For-profit utilities produce cheaper and more reliable electricity than government-owned and -run ones: This one goes back to the Reagan era, with Republicans arguing that the “free market” will always outperform government, including when it comes to generating and distributing electricity. In fact, each of us has only one wire coming into our homes or offices, so there is no possible competition to drive either improved performance or lower prices among for-profit utilities.

In fact, non-profit community-owned or government run utilities consistently produce more reliable electricity, serve their customers better, and charge lower prices. And the differences have become starker every year since, in 1992, President GHW Bush ended federal regulation of electric utilities. It’s why Texas, which has almost completely privatized its power grid, suffers some of the least reliable and most expensive electricity in the nation when severe weather hits.

— The electoral college protects our democracy: There was a time when both Democrats and Republicans wanted to get rid of the Electoral College; a constitutional amendment to do that failed in Congress by a single vote back in 1970. But after both George W. Bush and Donald Trump lost the White house by a half-million and three million votes respectively but ended up as president anyway, Republicans fell newly in love with the College and are fully planning to use it again in 2024 to seize power even if ten million more people vote for Biden this time (Biden won by 7 million votes in 2020).

This is just the tip of the iceberg.

Republicans are now defending billionaires buying off Supreme Court justices and most recently Lever News found that they’ve been spiffing over 100 other federal judges — who regularly vote in favor of the interests of corporations and the morbidly rich — in addition to Alito, Thomas, Roberts, et al.

Republicans are also claiming that:

— Trump isn’t a threat to our democracy and his promises to be a dictator are “mere hyperbole.”

— Letting Putin take Ukraine won’t put Taiwan and other democracies at risk.

— Ignoring churches routinely breaking the law by preaching politics while enjoying immunity from taxes is no big deal.

— Massive consolidation to monopoly levels across virtually every industry in America since Reagan stopped enforcement of our anti-trust laws (causing Americans to pay an average of $5,000 a year more for everything from broadband to drugs than any other country in the world) is just the way business should be run.

— Teaching white children the racial history of America will make them feel bad, rather than feel less racist and more empathetic.

— Queer people are groomers and pedophiles (the majority in these categories are actually straight white men).

— Banning and burning books is good for society and our kids.

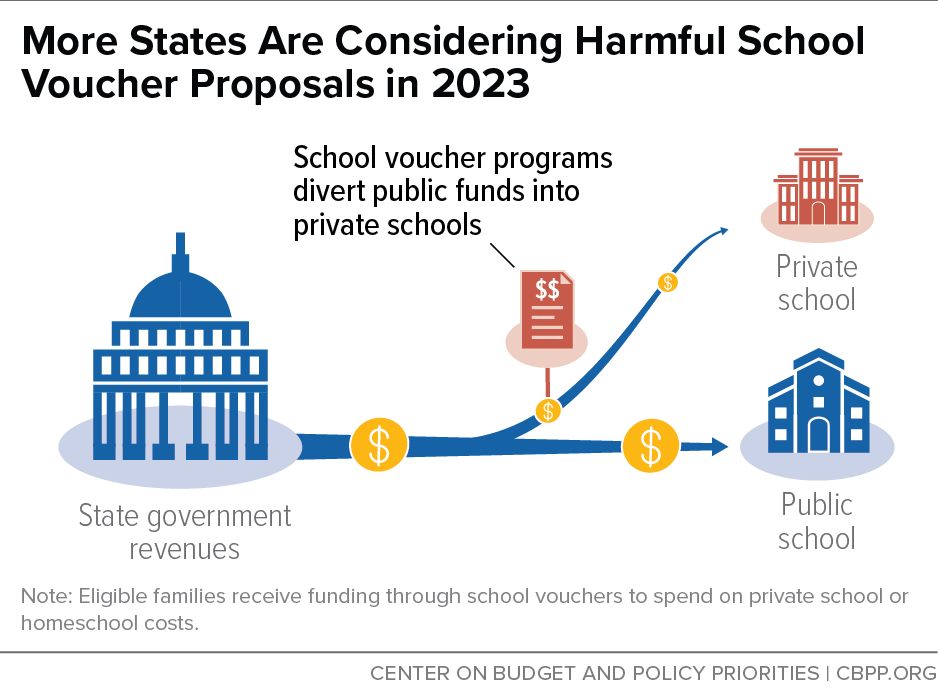

— Ending public schools with statewide voucher programs will improve education (every credible study shows the opposite).

I could go on, but you get the point. When will America — and, particularly, American media — wake up to these scams and start calling them out for what they are?

I’m not holding my breath, although you could help get the ball rolling by sharing this admittedly incomplete list as far and wide as possible.