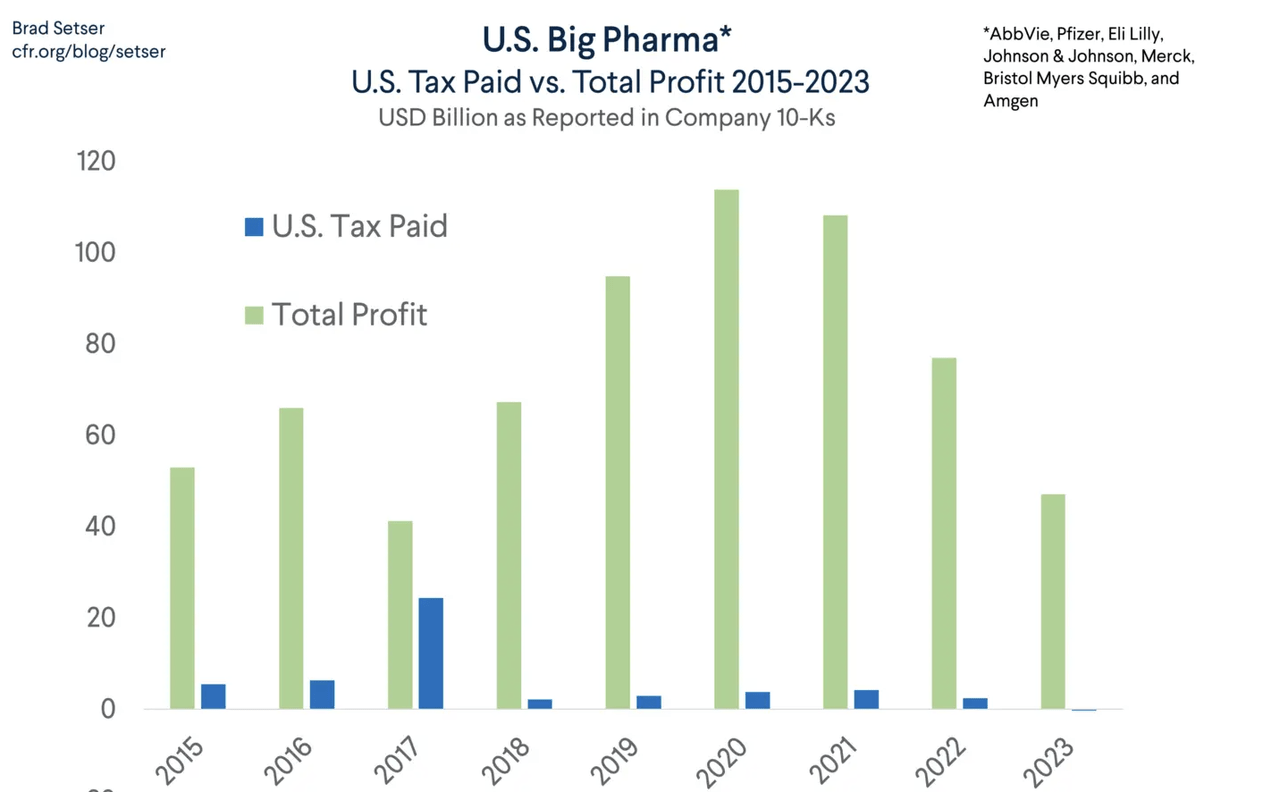

Big Pharma makes big profits in the U.S., but has mastered the accounting trick of paying little or no taxes. Thanks to Trump’s big corporate tax cut in 2017, most of these corporations are able to transfer their profits to other countries where the tax rates are lower.

Although they receive the bulk of revenue from sales in the U.S. and report large overall profits, most large U.S.-based pharmaceutical companies don’t pay any taxes in the country.

A new analysis of corporate taxes paid by the largest U.S. pharma companies by the Council on Foreign Relations found that in 2023, the top seven based on revenue had a combined U.S. tax obligation of (-)$250M.

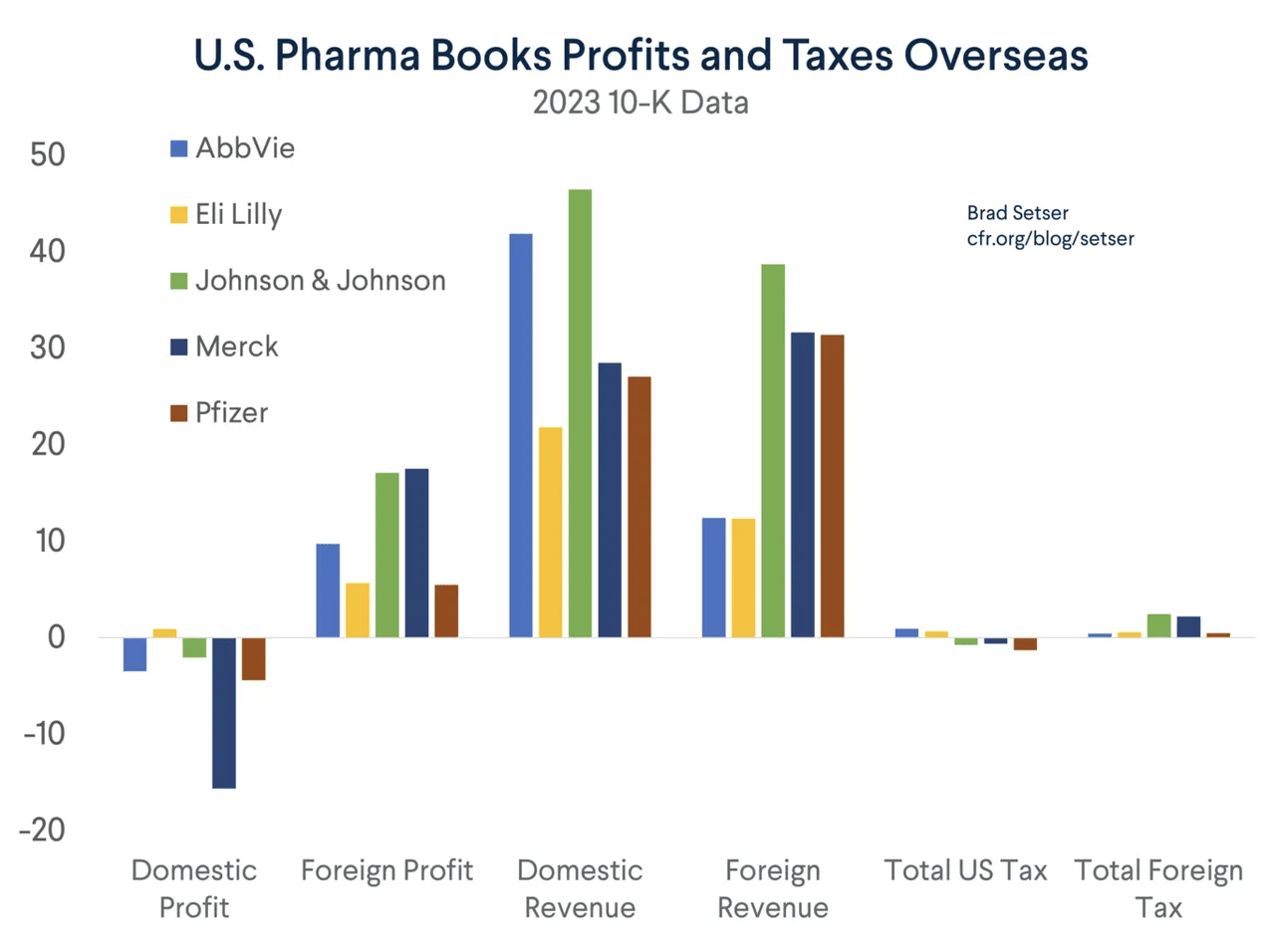

CFR noted that Pfizer (NYSE:PFE), Johnson & Johnson (NYSE:JNJ), and Merck (NYSE:MRK) had no U.S. tax liability in 2023 and even had tax losses to carry forward.

AbbVie (NYSE:ABBV) did pay a little in U.S. taxes, but CFR authors Brad Setser and Michael Weilandt added that the company books the profits from its blockbuster drug Humira (adalimumab) in Bermuda because that country has no corporate income tax.

The duo also noted that, based on 10-K filings, many pharmas reported losses in the U.S. in 2023. Among them: Pfizer, $4.4B; AbbVie, $3.5B; Merck, $15.6B; and Johnson & Johnson $2B.

However, Setser and Weilandt estimated that Eli Lilly (LLY) reported a $0.9B U.S. profit.

Gilead Sciences (GILD) is an outlier among large biopharmas. It is the eighth largest U.S. biopharma by revenue, yet reported paying $3B in U.S. taxes in 2023.

Setser and Weilandt explain how pharmas can book U.S. profits overseas to save on paying U.S. taxes. The first reason is the Tax Cuts and Jobs Act of 2017, which the pair say provided for lower taxes on foreign profits than U.S. profits, providing an incentive for companies to book more profits overseas.

Second, since many drugs sold in the U.S. market are actually made abroad, pharma companies decide to book those profits in the country of manufacture.

Finally, many pharmas have moved their intellectual property to wholly owned subsidiaries in locations with more favorable tax rates than the U.S.

Open the link to read the rest of the article.

And there are warnings that if you take a prescribed drug, one can get “UNUSUAL URGES.” What a riot.

Wonder what those “UNUSUAL URGES” could be?

LikeLike

UNUSUAL URGES ==Suicide! They don’t want to say the word or people won’t want to ingest their drugs.

LikeLike

The TV ads for prescriptions drugs are hilarious. First they show you the happy person who took the drugs. Then they warn you of horrible side effects that might or might not occur: stroke, nausea, vomiting, suicidal thoughts, death. I never want to buy any of them after I see the ad.

LikeLike

The pharma people through the ads want the general public to be telling their doctors which drugs the doctors should be prescribing. In other words, the pharma people are trying to get the general public to tell doctors how to do their business and help the pharma companies to sell their products. When an ad comes on the TV for meds I true the sound off. Can’t stand to hear the BS.

LikeLike

I think the practice of advertising drugs is so morally corrupt that I visualize myself going on a crusade against the perpetrators of this outrage, following Peter the Hermit to some silly fate.

LikeLike

Agree. I put the advertising of medicines right up here with attorneys advertising on billboards and TV. Those folks remind me of ambulance chasers.

LikeLike

Well, like….duh! Now can they expose the rest of the rot that involves Big Pharma, please! Pharma-bro was just the tip of the iceberg.

LikeLike

This finding surprises no one. Big corporations will use any and all tax avoidance strategies at their disposal. Their goal is to maximize profit. They are not patriots. If we want to see change, we need to change the tax laws.

LikeLike

United States citizens are finding it harder and harder to afford the medicines they need. The prices and co-pays keep going up but the availability of the medicines are getting less and less. The Pharma people continually run ads all day long, particularly at night, for all the meds they are pushing. These ads are not cheap. The costs of the ads are just added to the price folks need to pay. The Pharma CEOs, Boards of Directors, and other top dogs get their parachute packages on the backs of the folks that need their meds. And, we know certain US legislators are getting their share of the profits so do NOT expect the tax laws to change any time soon. Legislators are not going to kill one of their cash cows.

LikeLike

Lina Khan, the Federal Trade Commissioner is vigorously chasing after the monopolistic practices of the mega corporations, she is despised by MAGAs, she was a speaker at the recent AFT Convention – extremely impressive.. Weingarten has the right friends👏

LikeLike

Born in London to immigrant Pakistani parents, Khan moved to the US at age 11 and graduated from the Mamaroneck, NY, public schools.

LikeLike

I was wondering if the discovery that drugs for diabetes can also be used for treating obesity has led to the shortage of the drug formulations meant for diabetes. The price of the obesity formulations is ridiculous. The drug companies can make incredible profits with them as opposed to the growing price restrictions for diabetes meds, creating an artificial shortage of the formulations intended for tx of diabetes.

LikeLiked by 1 person

Not to mention that the majority of the basic research that is done is funded by the NIH, so the drug companies get the benefit of not paying what should be their costs. Big pharma spends more on advertizing than on research.

LikeLike